Bank accounts is an essential requirement for everyone, and Government is also emphasising with various programs and schemes to bring everyone towards financial freedom with the bank account. However, people more often not satisfied with the banks service charges these days and troubled with the service charges.

Even if you do not care about small amounts debited from your account, this will amount to major amount without a proper financial planning. Though, there are several service charges levied by the banks to customers, these are easy to avoid with following some of the simple tricks.

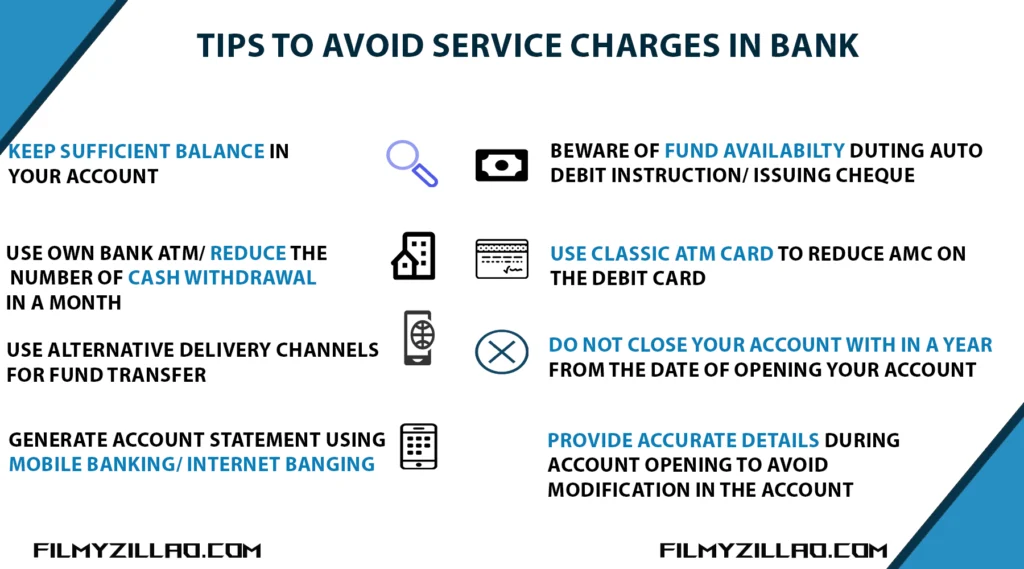

Here in this article, we will see how to avoid such common service charges in the bank account with a right choice.

1. Minimum Balance Charges

Banks charge penalties if you don’t maintain the minimum average balance (MAB) in your savings or current account.

How to avoid it:

- Know the MAB requirement for your account type.

- Set a reminder to keep track of your monthly balance with mobile banking and Internet banking which shows the current Average Balance of your Account.

- Consider converting your account to a Basic Savings Bank Deposit Account (BSBDA) – these accounts have no MAB requirement.

2. ATM Withdrawal Charges

Banks often provide a limited number of free ATM withdrawals per month in other Banks ATM’s, beyond which they charge a fee. As per RBI Norms

- Maximum free transaction in other bank ATM is limited to 3 Transaction in Metro Cities and 5 Transaction in other Areas.

How to avoid it:

- Use your own bank’s ATM if possible.

- Withdraw larger amounts less frequently to stay within the free limit.

3. Transaction Charges

Fund Transfer through banks will cost you money in the form of service charges for transaction facility like NEFT, RTGS and IMPS. These might look smaller amount, but regular transaction will accumulate to more amount in long run.

How to avoid it:

- Use Alternative Delivery channels like Mobile Banking, Net banking.

- As per RBI regulations NEFT done through online mode has no charges.

- Though banks can charge you for other forms of transaction, this is nominal compared to the service charges in banks.

4. Statement Charges

Account statement is a basic requirement for availing loan facility in the financial institution. Banks provide free statement through passbook printing, however if you request for a physical statement through banks this will induce charges as per the transaction done.

How to avoid it:

- Statement can be generated digitally with the Mobile Banking/ Internet Banking.

- Generating E Statement is simple and efficient and reduce cost for you as most of the banks accept E Statemen for the loan processing.

5. Cheque Bounce Charges

Penalty charges apply if you issue a cheque without sufficient funds or if auto-debit instructions fail.

How to avoid it:

- Monitor your balance regularly for cheque clearing.

- Set up auto-debit reminders or alerts to avoid failed Auto debit.

6. ATM Maintenance Charges

ATM card saves so much effort and cost by providing cash in the vicinity of our requirement. But, this facility comes with a cost as the ATM card maintenance charge is debited from the account annually.

How to avoid it:

- Avoid getting premium Debit Card variant if you are only going to use it for cash withdrawal as premium debit cards will cost 2 to 5 times more than the classical card variant.

- If you have only less transaction opt for Jan Dhan Account with free ATM Card.

7. Account Closure Charges

If you are not aware of it there is a Account Closure Charges applicable on the following condition.

- If you close your account after 7 Days and within 1 Year of Account opening date.

- Avoid closing your account within the stipulated time. i.e., one year from the date of account opening.

- Do not open multiple account for easy management.

8. Charges for Modification of Account Details

Banks usually charge when you modify your details in your account. The following modifications in your account might attract charges.

- Name Change

- Mobile Number/ E- mail ID

- Nomination Details

- Address

How to avoid it:

- Try to give accurate and up to date information for your account during the account opening time itself.

- If it is possible update the details in the online mode.

Conclusion

Bank imply service charges for various products and these small sums of money can heavily attack us if goes unnoticed. There are some simple tricks to avoid them.

Some of them are

- Do not use a greater number of Accounts. High number of accounts will lead to more service charges, even for the services we do not avail. Also, a smaller number of accounts is easy to manage.

- Use Alternative Delivery Channels like Mobile Banking, Internet Banking, UPI to its potential.

- Avoid availing products that you might not want even if bank implies on it.

- Use digital cash payment options more compared to the phsical cash payment.

By following these simple tips, you can avoid unnecessary bank charges and make the most of your banking experience. Being proactive and informed about your account’s terms and conditions goes a long way in saving money.