Last updated on May 22nd, 2025 at 06:08 pm

As the Financial Year 2024-25 comes to a close, it’s time for salaried individuals, self-employed professionals, and business owners in India to get ready for Income Tax Return (ITR) filing. Filing your ITR on time not only helps avoid penalties but also ensures faster refunds and smooth financial planning.

In this article, we’ll cover when to file ITR, key deadlines, penalties for late filing, and how to file your return — both online and offline.

When Does ITR Filing for FY 2024-25 Start?

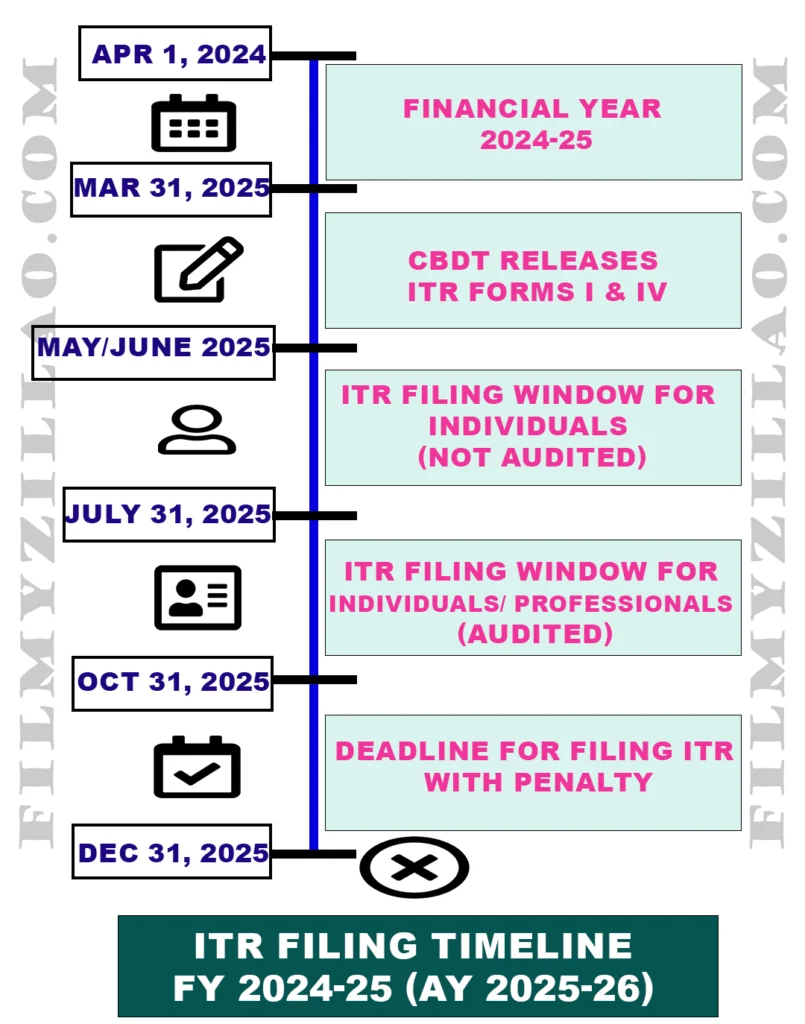

The ITR filing season usually begins in April, after the Central Board of Direct Taxes (CBDT) releases the relevant ITR forms (typically in February or March). However, for FY 2024-25 (AY 2025-26), the ITR forms are yet to be released by CBDT.

This means that the ITR filing portal on the Income Tax Department website has not opened yet. The filing is expected to begin by the third or fourth week of May 2025, especially for salaried individuals, once they receive their Form 16 from employers in late May or June.

What is the Last Date to File ITR for FY 2024-25 (AY 2025-26)?

The deadline for filing your ITR depends on whether your accounts need to be audited.

| Taxpayer Type | ITR Filing Deadline |

|---|---|

| Non-Audit Taxpayers | 31st July 2025 |

| Audit Cases | 31st August 2025 |

| Belated Return Filing | 31st December 2025 (with penalty) |

If you miss the July/August deadline, you can still file a belated return by 31st December 2025, but you’ll have to pay a late filing penalty and interest on unpaid taxes.

Penalty for Late ITR Filing

Filing your Income Tax Return after the due date results in a penalty under Section 234F. The penalty amount depends on your total income.

| Total Income | Penalty Amount |

|---|---|

| Up to ₹5 lakh | ₹1,000 |

| Above ₹5 lakh | ₹5,000 |

Interest on Unpaid Tax

If you delay paying your income tax, interest at 1% per month (or part of the month) is charged on the outstanding amount, under Section 234A.

How to File Your ITR in India

There are two convenient ways to file your income tax return:

1. Online Method (Recommended)

- Visit the Income Tax e-Filing Portal.

- Log in using your PAN and password.

- Select the appropriate ITR form.

- File and verify digitally (via Aadhaar OTP, Net Banking, etc.).

- Download acknowledgment after submission.

2. Offline Method

- Download the Excel/Java utility from the Income Tax website.

- Fill in your income details offline.

- Generate and upload the XML file on the portal.

- Verify your return using EVC or ITR-V.

Important Points to Remember

- Minimum Income for ITR Filing: Anyone earning above ₹2.5 lakh per year must file ITR, even if tax is not payable.

- Filing Early Is Better: Submitting your return early can help avoid last-minute issues and speed up refund processing.

- Online Filing Is Easier: Online ITR filing offers a smoother experience, faster verification, and quicker refunds.

Conclusion

ITR filing is an important financial responsibility. Whether you’re a salaried employee or running a business, keeping track of the Income Tax filing dates for FY 2024-25 (AY 2025-26) is crucial. By filing early and choosing the right method, you can avoid penalties, reduce stress, and manage your finances better.

Stay updated with the latest announcements from the Income Tax Department and make sure to file your returns on time!