Opening a bank account is essential for financial management and transparency, especially for non-individual entities like Trust, Societies, Hindu Undivided Families (HUFs), Clubs, and Unincorporated Associations.

Indian banks follow KYC (Know Your Customer) norms set by the RBI, which require submission of specific documents.

This guide will help you understand the documents required to open a bank account for different non-individual entities in India.

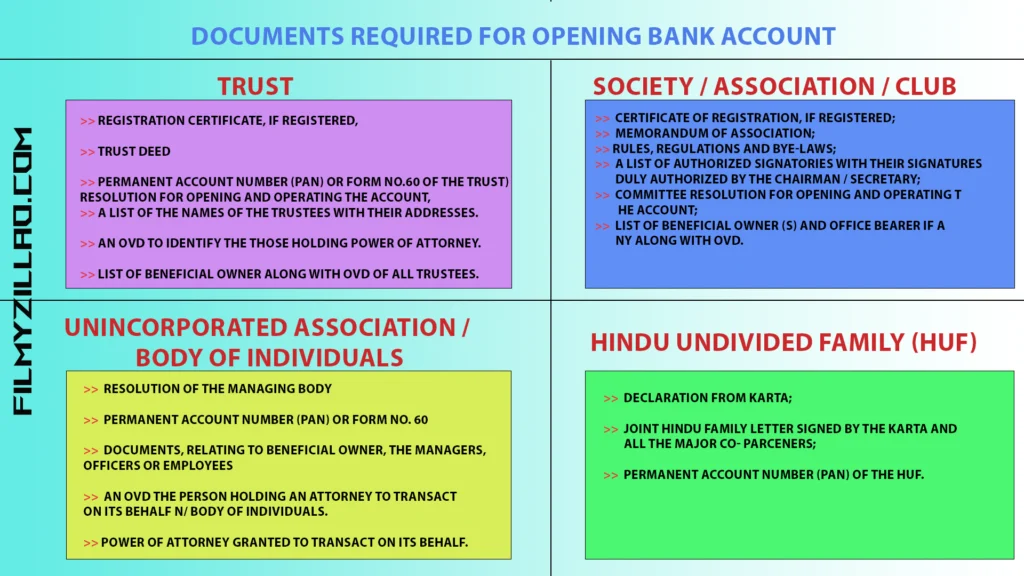

1. Trust

A Trust can be private or public and must provide valid proof of its formation and authorized signatories.

Required Documents:

- Registration certificate, if registered,

- Trust deed

- Permanent Account Number (PAN) or Form No.60 of the trust) Resolution for opening and operating the account, signed by all the Trustees.

- A list of the names of the trustees with their addresses.

- An OVD to identify the those holding Power of Attorney.

- List of Beneficial Owner along with OVD of all trustees.

2. Society / Association / Club

These are typically registered under the Societies Registration Act or other applicable laws. They operate for charitable, educational, or recreational purposes.

Required Documents:

- Certificate of Registration, if registered;

- Memorandum of Association;

- Rules, regulations and bye-laws;

- A list of Authorized signatories with their signatures duly Authorized by the Chairman / Secretary;

- Committee resolution for opening and operating the account;

- List of Beneficial Owner (s) and office bearer if any along with OVD.

3. Unincorporated Association or Body of Individuals

These include associations not registered under any formal Act but formed for a common cause or activity.

Required Documents:

- Resolution of the managing body of such association or body of individuals.

- Permanent Account Number (PAN) or Form No. 60 of the unincorporated association or a body of individuals.

- Documents, as specified in Section 16, relating to beneficial owner, the managers, officers or employees, as the case may be, holding an attorney to transact on its behalf.

- An OVD the person holding an attorney to transact on its behalf and Information to collectively establish the legal existence of an association/ body of individuals.

- Power of attorney granted to transact on its behalf.

NOTE : Explanation: Unregistered Trusts I. Partnership Firms shall be included under the term

'Unincorporated Association.

4. Hindu Undivided Family (HUF)

HUF accounts are opened under the name of the family’s Karta (head of the family), who manages the affairs.

Required Documents:

- Declaration from Karta;

- Joint Hindu family letter signed by the Karta and all the major co- parceners;

- Permanent Account Number (PAN) of the HUF.

Important Points to Remember

- Always carry original documents for verification while submitting photocopies.

- Ensure all resolutions or declarations are properly signed and stamped.

- Banks may ask for additional documents based on internal policies or updated RBI guidelines.

- For all entities, KYC compliance is mandatory for account opening and future operation.

Conclusion

Opening a bank account for a Trust, Society, HUF, or Unincorporated Association in India involves specific documentation to meet compliance requirements. Ensuring all documents are complete and accurate helps avoid delays and establishes a smooth banking relationship.

If you’re planning to open an account for your organization, prepare these documents in advance and consult your preferred bank for any additional requirements.