Last updated on December 25th, 2024 at 03:57 pm

Mortgage is a type of charge bank create on a property for safe lending. Thus it is really important that you have a proper knowledge about types of charges bank creates before applying loan.

There are three types of charges banks create on the security provided by borrower. The charges are namely Pledge, Hypothetication and Mortgage. The type of charge created is based on the property provided as a security.

In this article we give you details about the Mortgage and various types of Mortgage and how they function. Read the article completely for further details.

What is Mortgage?

Mortgage is defined in Transfer of Property Act 1882 as transfer of interest in specific immovable property for securing present debt, and future debt or for performance of an engagement which may give rise to a pecuniary obligation.

Mortgage is usually created on the immovable properties like Land and Buildings. Though the borrower enjoys the property, the lender has the right to sell the property if the borrower failed to repay the loan.

The conditions of the Mortgage differs for different type of Mortgage. Thus find out below the types of Mortgage and how it functions.

Types of Mortgage

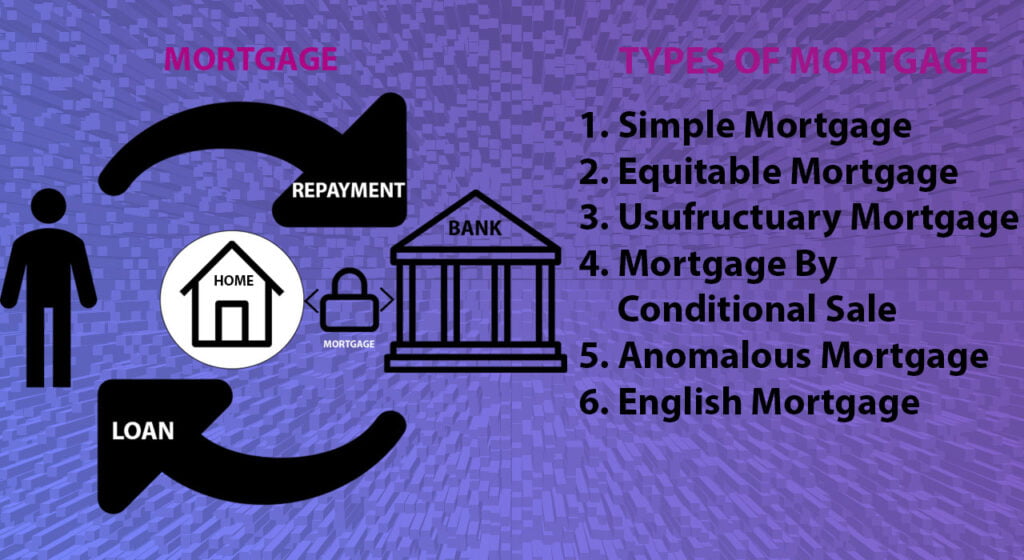

There are Six types of Mortgage as given below

- Simple Mortgage

- Equitable Mortgage

- Usufructuary Mortgage

- Mortgage By Conditional Sale

- Anomalous Mortgage

- English Mortgage

Types of Mortgage

1. Simple Mortgage

Simple Mortgage is the basic form of Mortgage. Thus in Simple Mortgage the property is registered to the mortgagee (Bank).Mortgagor binds himself personally to repay the amount failing which bank has right to sell the property through court or file suit for recovery.

2. Equitable Mortgage (EQM)

Equitable mortgage is created by depositing original Title Deeds to the lender. Thus the borrower gives his consent to give the original title deeds to the lender. Though in some states it requires registration, in most of the regions the registration is not mandatory.

But to prove intention in case of need, attendance register is maintained by the lender and it should be written by borrower himself or his relative in case he is illiterate.

Mortgagee also obtain Oral Assent of the Mortgagor (Borrower) in the register.

- In case of housing loan to NRI power of attorney holder, who is a relative of NRI customer can create mortgage. But the original borrower should confirm the execution of documents and creation of mortgage subsequently.

- EQM can also be created by certified copy of original in very special circumstances, with permission of appropriate authority, Where original is irretrievably lost an FIR should be filed.

3. Usufructuary Mortgage

In Usufructuary Mortgage the possession of the property is handed over to the Mortgagee. Thus the Mortgagee is entitled to enjoy the rent, income and other benefits accruing on the property for repaying the obligation.

4. Mortgage By Conditional Sale

It is mortgage whereby the mortgagor ostensibly (only perceived and not real) sale the immovable property to mortgagee on certain conditions. But the sale will be absolute if the money is not repaid on specific date and on payment, the transaction of ostensible sale become void.

5. Anomalous Mortgage

If there are One or More types of Mortgages are combined in a single property it is called Anomalous Mortgage.

6. English Mortgage

In English mortgage the ownership of property is transferred to the mortgagee and upon fulfillment of the contract, ownership is re- conveyed to the mortgagor.

Conclusion

This articles gives the brief information on the six types of Mortgages that are commonly used. But the decision on type of the Mortgage selection is based on the Bank’s Policy and does not involve the borrower.

But you can always compare the different banks and choose the one that serving the type of mortgage you want. However the type of Mortgage does not affect the other aspects of the loan such as Quantum, Interest Rate, etc.

We hope the article is helpful. But for any other queries, raise your questions on Comment Section we will answer it.

Pingback: Pledge VS Hypothecation VS Mortgage |Differences & Comparison - Fil Zill

Pingback: Types of Charge created on Security/ Asset in Finance - Fil Zill

Pingback: The Basel Capital Accord: Enhancing Global Bank Stability - Fil Zill