Last updated on May 19th, 2025 at 05:05 pm

Capital gain is the profit earned from selling the assets like Stocks, Property, jewellery and Bonds. The capital gain tax rate is revised for all the assets in the Budget 2024-25 and came into effect on July 23, 2024. And the Union Budget 2025-26 did not make any changes to the Capital Gain Taxes in India.

Thus, from July 23, 2024, Long-Term Capital Gains are taxed at 12.5%, without indexation benefits. Short-Term Capital Gains are taxed at Slab Rates.

In this article you can learn what are the different types of Capital gain (Short-Term and Long-Term), Tax rates for different securities and Exemption on Capital Gain Tax.

Types of Capital Gain

Capital Gain is categorised into two types based on the period of holding the assets as given below.

- Short-Term Capital Gain Tax (STCG)

- Long-Term Capital Gain Tax (LTCG)

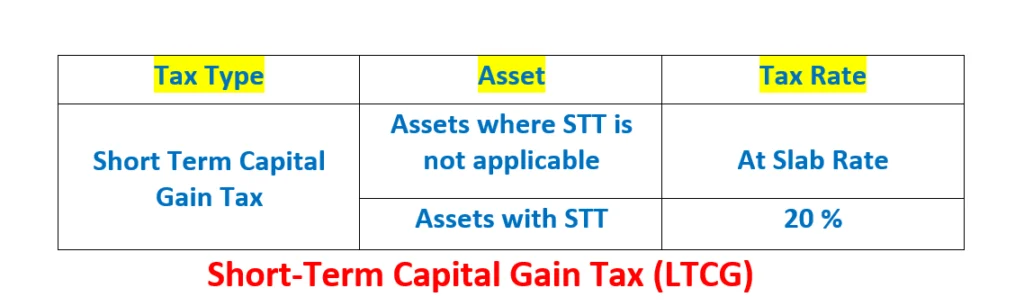

1. Short-Term Capital Gain Tax (STCG)

- When the Profit is earned from selling the assets within one year of purchase it is called Short-Term Capital Gain Tax (STCG).

- For Securities without STT (Securities Transaction Tax) the gain is taxed as per the Income Tax Slab of an individual.

- For Securities where STT is applicable the gain is taxed at 20%.

2. Long-Term Capital Gain Tax (LTCG)

- When the Profit is earned from selling the assets after one year of purchase it is called Long-Term Capital Gain Tax (LTCG). They are taxed usually lower rate than regular income.

- General applicable Tax rate is 12.5%.

Exemption on Capital Gain Tax

Though there are capital gain tax on the majority of assets, there are some exemptions on paying Capital Gain Tax. These are listed below and can be claimed as per the instruction.

1. Section 54: Exemption on Sale of Residential Property on Purchase of Another Residential Property

Tax on Sale of Residential Property is exempted if the amount is invested in purchase of another property.

- The property should be purchased before 1 year or after 2 years from the sale of an asset.

- If the new house is constructed it has to be done with in 3 years from the date of sale..

- The new property purchased should be held for 3 years. If sold with in 3 years the exemption will be reversed.

2. Section 54F: Exemption on Capital Gains on Sale of any Asset other than a Residential Property

If any asset other than Residential property is sold with a capital gain and the amount is invested in House, the tax is exempted.

- The property should be purchased before 1 year or after 2 years from the sale of Long Term Capital asset.

- The house is self-construction then it has to be completed within 3 years of gain.

- The house should be held on for three years for gaining exemption.

3. Section 54EC: Exemption on Sale of Long Term Asset if invested in Specific Bonds

If Long Term Asset is sold with capital gain, the gain can be exempted if the amount is invested in certain government bonds.

- The amount should be invested in bonds of National Highway Authority of India (NHAI), Rural Electrification Corporation (REC), Power Finance Corporation (PFC) or Indian Railway Finance Corporation (IRFC).

- The investment should be made within 6 months from the date of gain.

Conclusion

It is important to understand the Capital Gain Rules to have a better Investment Strategy and create a healthy investment portfolio. Moreover, you can avoid excess tax payment and claim Exemption on the eligible items.