Last updated on December 25th, 2024 at 03:56 pm

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) was established to cover the credit loss incurred by lenders when Micro and Small Enterprises (MSEs) default on loans.

This scheme facilitates collateral-free credit, making it easier for entrepreneurs to access funding while ensuring banks have risk-free loan options. Here’s everything you need to know about CGTMSE.

What is CGTMSE?

The Credit Guarantee Scheme for Micro and Small Enterprises (CGSMSE) is a trust founded by the Government of India under the Ministry of Micro, Small, and Medium Enterprises (Mo MSME) and the Small Industries Development Bank of India (SIDBI) on August 1, 2000.

It aims to provide unsecured loans to the high-risk MSME sector, encouraging financial institutions to lend without additional risk concerns.

Eligibility for CGTMSE Coverage

The following loans are eligible for CGTMSE coverage:

- Credit facilities sanctioned to Micro and Small units as per the MSMED Act, 2006.

- Loans for retail and wholesale trade activities with coverage up to ₹5 crores.

Non-Eligible Loans

Certain types of loans are not covered under the CGTMSE scheme. These include:

- Credit facilities where risks are already covered under other schemes (e.g., Deposit Insurance and Credit Guarantee Corporation, ECGC).

- Loans to Self-Help Groups (SHGs).

- Loans already covered under other guarantee schemes like CGFMU or CGSSI.

- Credit facilities inconsistent with any law or directives from the Reserve Bank of India (RBI) or the Central Government.

- Borrowers who previously defaulted on loans under CGTMSE.

- Clean overdrafts (ODs) and cash credit (CC) accounts.

- FITL accounts and partially converted working capital loans.

Maximum Coverage Under CGTMSE

The scheme’s coverage varies depending on the sector and borrower. Here are key points:

- Maximum Loan Coverage: ₹5 crore per borrower.

- Eligibility Conditions: The loan should not have been previously covered under CGTMSE or restructured in the last year.

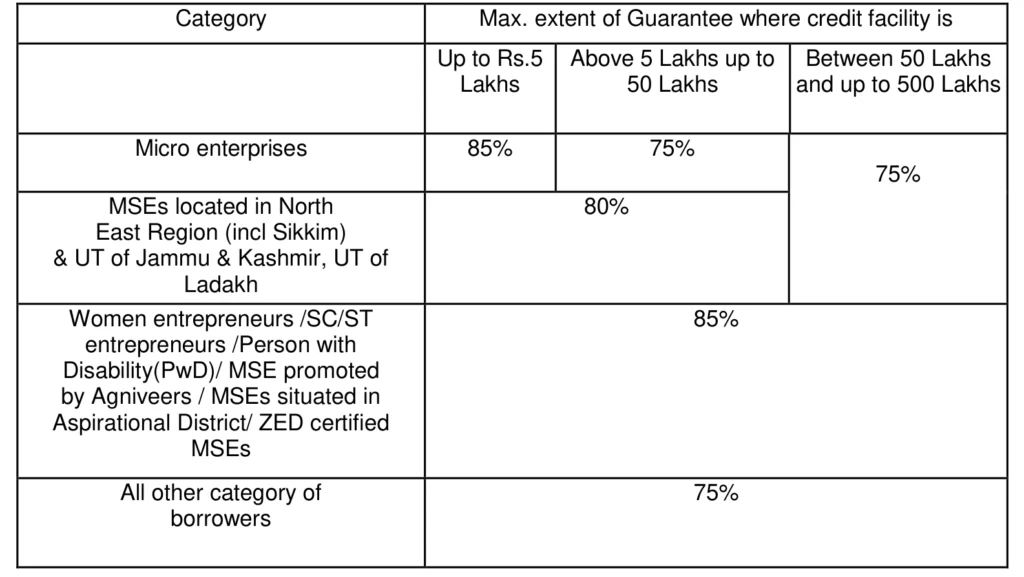

- Coverage Percentage: Guarantee coverage ranges from 75% to 85% based on the borrower’s category.

- Enhanced Limits: From April 1, 2023, the ceiling for credit guarantees per borrower was raised from ₹2 crore to ₹5 crore.

How to Apply for CGTMSE Cover

Borrowers cannot apply for CGTMSE cover directly. Instead, they should:

- Approach Their Bank: Banks automatically cover eligible loans under the CGTMSE scheme.

- Request Coverage: If the bank does not offer coverage, borrowers can request it.

Annual Guarantee Fee (AGF)

To avail of CGTMSE coverage, borrowers must pay an Annual Guarantee Fee (AGF), which varies by loan amount:

| Loan Amount (₹) | AGF Rate (per annum) |

|---|---|

| Up to 10 lakh | 0.37% |

| Above 10 lakh to 50 lakh | 0.55% |

| Above 50 lakh to 1 crore | 0.60% |

| Above 1 crore to 2 crore | 1.20% |

| Above 2 crore to 5 crore | 1.35% |

AGF is calculated on the guaranteed amount for the first year and on the outstanding amount for subsequent years.

Benefits of CGTMSE

- Risk Mitigation for Banks: Encourages banks to lend to MSMEs without collateral, reducing perceived risk.

- Faster Loan Approvals: Simplifies loan approval processes for borrowers.

- Inclusive Growth: Supports entrepreneurs and underprivileged sectors in accessing finance.

Conclusion

The CGTMSE scheme empowers entrepreneurs by providing a safety net for unsecured loans while reducing the burden on banks. With expanded coverage and benefits, it continues to play a pivotal role in fostering the growth of MSMEs across India.

If you’re an MSME looking for funding, consider reaching out to your bank to leverage this scheme for your business needs.

Pingback: Stand-Up India Scheme: A Comprehensive Guide for SC/ST and Women Entrepreneurs - Fil Zill

Pingback: PM Vishwakarma Scheme: Empowering India's Traditional Artisans - Fil Zill