In the exciting world of the Indian stock market, one common question is: “How are stock prices determined?” If you’re curious about what makes a stock price go up or down, this article is for you. We’ll explore how prices change, what factors influence them, and how investors can use this knowledge to make smarter decisions.

What Decides Stock Prices in Share Market?

At its core, the stock market works on supply and demand — just like a local market. A stock represents a small ownership in a company. When many people want to buy a stock (high demand), its price goes up. When more people want to sell (high supply), the price drops.

Example:

Let’s say XYZ: Ltd., a finance company, is trading at ₹100 per share. Suddenly, good news about the finance sector is announced. More people rush to buy the stock, and within a day, the price jumps to ₹110 — a 10% rise!

On the flip side, suppose ABC Industries, a healthcare firm, is at ₹100. Bad news about healthcare causes panic, and people start selling. The stock falls to ₹80 — a 20% drop.

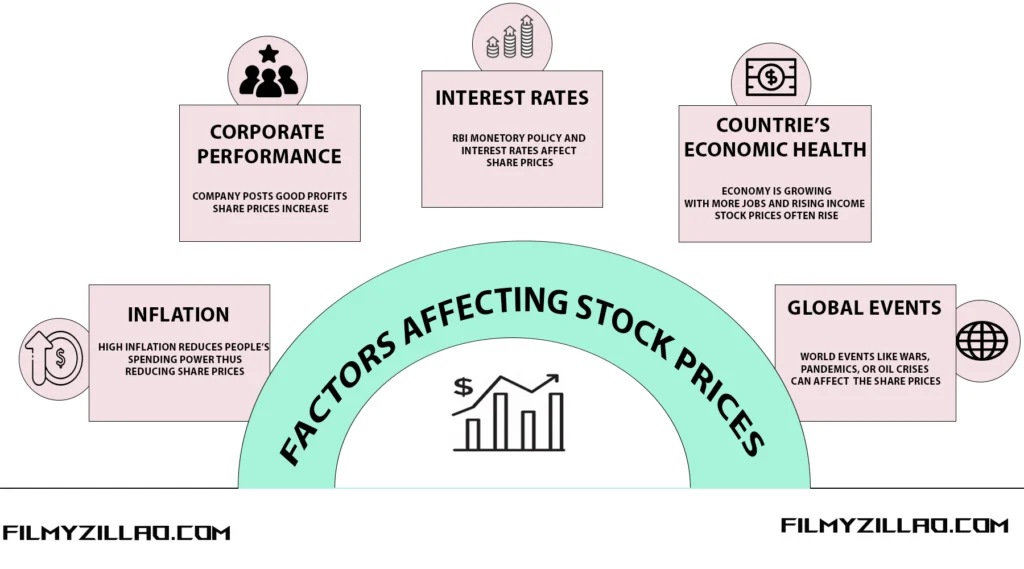

Key Factors That Affect Stock Prices in India

Several things can influence the buying and selling of stocks. Here are the main ones:

1. Corporate Performance

If a company posts good profits or expands into new markets, investors become confident and buy more of its shares. But if it faces losses, scandals, or management changes, people may sell.

2. India’s Economic Health

When the Indian economy is growing — with more jobs and rising income — stock prices often rise. If there’s economic trouble (like rising unemployment or slowing growth), prices may fall.

3. Inflation

High inflation reduces people’s spending power. It may make investors nervous, leading to lower stock prices. Low inflation generally supports rising prices.

4. Interest Rates

When the Reserve Bank of India (RBI) increases interest rates, loans get expensive, profits may dip, and stocks fall. Low interest rates usually support higher stock prices.

5. Consumer Spending

When people are spending more, companies earn more. This leads to rising stock prices. But during downturns or uncertainty, spending drops — and so do stock prices.

6. Global Events

. However, markets usually recover over time.

7. Big Investors

Large institutional investors (like mutual funds and foreign investment firms) buy and sell big volumes. Their moves can have a major impact on prices.

How Stock Prices Change in Real Time

With today’s digital systems, stock prices can change every second. New information — like company news, government reports, or global developments — can instantly affect stock values.

For example:

- A new product launch might push prices up.

- A lawsuit might bring them down.

The Indian stock market reacts quickly, and prices update in real time.

Tips for Navigating the Indian Stock Market

If you’re just starting out, here are a few smart strategies:

1. Get Expert Advice

Talk to a trusted financial advisor who understands Indian stocks. They can help you pick the right investments.

2. Learn for Yourself

Understand basics like how the stock market works, how to read a company’s financials, and how economic news affects stocks.

3. Stay Updated

Follow news, check company reports, and use reliable stock trading apps to keep track of your portfolio.

4. Be Patient

Don’t panic with short-term ups and downs. Long-term investors usually see better results by staying calm and consistent.

Conclusion

Stock prices in India move based on a mix of company news, economic data, investor behavior, and global events. Understanding these factors can help you make more informed decisions. Always remember: knowledge, patience, and a clear plan are the keys to success in the stock market.

FAQs About Stock Prices in India

Q1: What really drives stock prices in India?

A: Supply and demand are the biggest drivers. Good news means more buyers, which pushes prices up. Bad news means more sellers, and prices fall.

Q2: Can I predict stock price movements?

A: Not exactly. But analyzing trends, company performance, and expert insights can help make better predictions.

Q3: What happens when more people buy a stock?

A: If demand goes up and supply remains the same, the stock price usually increases.