Last updated on December 25th, 2024 at 03:57 pm

MUDRA (Micro Units Development and Refinance Agency Ltd) is a financial Institution created by Government to support small scale industries and Startup. It provides support to small industries by financing through Banks, Non Banking Finance Companies (NBFC) and Micro Finance Institutions (MFI).

MUDRA was introduced in 2016 by Union Finance Minister to provide easy and affordable finance to the entrepreneurs. Though there are many entrepreneurs with a great business ideas are there, they do not get a proper support.

Thus it become imperative to provide alternate and affordable funding to these small scale industries for healthy financial growth of the country.

What is MUDRA?

MUDRA is a Financing Agency that provides financial support to the Non corporate small scale industries. The financing is based on the type of business and the net worth of the business.

Thus it provides funds to the needy entrepreneurs in Manufacturing and Service Sector who does not get any other financial support.

MUDRA can be availed by startups and the existing business but the maximum loan that can be availed is Rs.10 Lakh.

Types of MUDRA Loan?

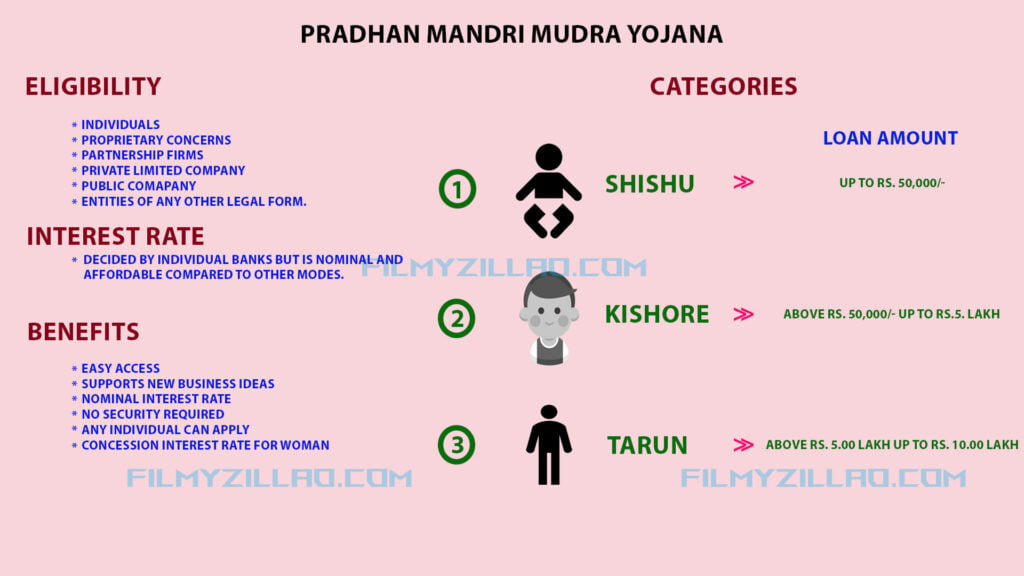

There three types of loans based on the amount of loan that can be availed through MUDRA scheme. They are

- SHISHU

- KISHORE

- TARUN

Maximum Finance

Under MUDRA a company can avail a loan of Maximum Rs. 10 Lakh. And it is categorized as below

| Category | Extend of Finance |

| SHISHU | up to Rs. 50,000/- |

| KISHORE | above Rs. 50,000/- up to Rs.5. lakh |

| TARUN | above Rs. 5.00 lakh up to Rs. 10.00 lakh |

Note that the MUDRA does not directly financing to the business entities but through the Financial institutions such as Banks, NBFC, MFI, etc.

Eligibility

Any Indian Citizen who has a business plan for a non-farm income generating activity such as manufacturing, processing, trading or service sector whose credit need is up to Rs. 10 lakh is eligible.

The following category are eligible for MUDRA Loan

- Individuals

- Proprietary Concerns

- Partnership Firms

- Private Limited Company

- Public Comapany

- Entities of any other Legal Form.

The banks also assess the lender for the necessary skills and Knowledge for doing the proposed business before lending.

Interest Rate: MUDRA Loan

The interest rate of MUDRA loan is decided by at the banks discretion. But the interest rate should be fixed rationally to provide affordable finance to the borrowers.

Moreover the woman beneficiaries can have an additional concession in interest rate under Priyadarshini Yojana as below

| Category | Interest Rate Concession |

| SHISHU | NIL |

| KISHORE | 1% |

| TARUN | 1% |

Nature of Facility

The financing under MUDRA is provided with the following options

- Term Loan

- Working Capital Loan

- Composite Loans

But the Integrated loan amount should not exceed the maximum limit of Rs. 10 Lakh.

Security Required

For availing the MUDRA Loan there is no need for any securities or collateral. But it requires

- Personal Guarantee of Promoters/Directors.

- Hypothecation of all assets acquired out of bank finance.

Benefits of MUDRA Loan

- MUDRA provides support to the industries/ Businesses that does not have an alternative financing options.

- It is easily accessible as it is provided through Banks, RRB, NBFC’s, etc.

- The interest is nominal and rationally chosen based on the economy to provide affordable rate.

- There is no security required for availing the loan. However the assets acquired with the finance are charged to the financial institutions.

Conclusion

In summary PMMY is a best option for the individuals who want to start a business. Thus it paves way for the entrepreneurs in the early days and supports them through the tough phase.

It also comes with the lower interest rate compared to the other mode of finance available. And it had helped millions of people since its inception.

For further queries please contact your bank as the specific conditions of the scheme does vary from bank to bank. We hope this article is helpful for other queries please put a comment and will clear it up for you.