Last updated on December 25th, 2024 at 03:58 pm

Bank Accounts become essential for everyone with the rapid adaptation of digital transaction in India. With the Financial Inclusion program introduction and subsequent efforts by Government made towards easing of KYC requirements the banking facility available to all sector of the people.

The greatest struggle faced by the government to bring the Financial services to every house hold is lack of Identification Proof with the people.

Thus to create a valid and unique identification to all citizen UIDAI has been created in 2019. But Government also provided other provisions so that no one is left out of the Financial Inclusion.

Hence it became possible to open bank account even without the valid Originally Valid Document (OVD). But the Account will have some limitation in operation.

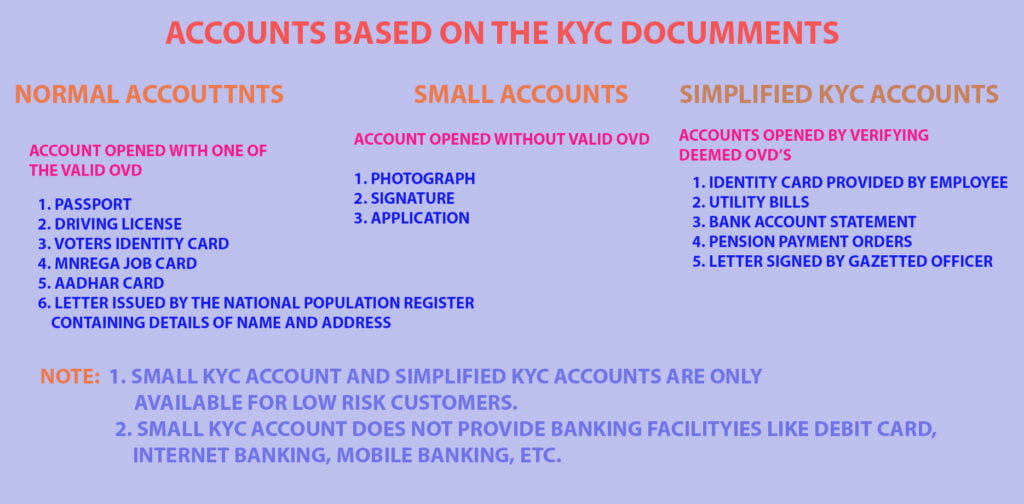

There are three types of Accounts you can open based on the KYC available and Due Diligence procedure followed by banks.

- Normal Account

- Simplified KYC Account

- Small Account

1. Normal Account

Normal KYC accounts are general account opened by banks. Thus you can enjoy all the benefits of banking facility with the Normal KYC accounts.

Normal Accounts requires any one of the 6 documents applicable OVD’s as “PROOF OF IDENTITY AND ADDRESS”

The following documents are accepted as an OVD for account opening

- Passport

- Driving License

- Voters Identity Card

- MNREGA Job Card

- Aadhar Card

- Letter issued by the National Population Register containing details of name and address.

Note Also

- PAN or Form 60 is Mandatory for account opening

- Recent Photograph should be provided during account opening as well as during Re-KYC updation.

- You can also submit your KYC for updation in Your personal details or you can request for a change in OVD with your account.

Address Proof

In case you have recently changed your home and the address on your OVD differs from your present address. You can provide following documents as a temporary Address Proof called Deemed Address Proof.

But the document provided is valid only for 3 months.

The following documents are accepted as a Deemed OVD.

- Property or Municipal tax receipt

- Utility bill which is not more than two months old of any service provider (electricity, telephone, post-paid mobile phone, piped gas, water bill)

- Pension or family pension payment orders (PPOs) issued to retired employees bGovernment Departments or Public Sector Undertakings, if they contain the address

2. Simplified KYC Account

Simplified KYC accounts are provided when anyone does not able to produce valid KYC documents (OVD’s) with a justified reason.

But Simplified KYC is acceptable for only low risk customers who does not have a valid OVD.

Banks will accept the following documents for identification of Customer.

- Identity Card with applicants photograph issued by Central / State Government Department, Statutory / Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks and Public Financial Institution.

- Utility bill which is not more than two months old of any service provider.

- Letter issued by a Gazetted Officer with a duly attested photograph.

- Bank account or Post Office savings bank account statement.

- Pension or family Pension Payment Orders (PPOs) issued to retired employees by Government Departments or Public Sector Undertakings, if they contain the address.

- Letter of allotment of accommodation from employer issued by State or

- Central Government departments, statutory or regulatory bodies, and public sector undertakings, scheduled commercial banks, financial institutions and listed companies. Similarly, leave and license agreements with such employers allotting official accommodation.

Small Account

Small KYC accounts are opened for the people who does not have a valid KYC and are in the low risk catagory.

Thus thid account is opened just with the Photograph and Signature of the customer.

But the Small KYC Account has a limitations in operation as below.

Limitations on Small Account

- Balance in the account at any point of time should not exceed Rs.50,000/-.

- Total of all debits and transfers in a month should not exceed Rs.10, 000/-.

- Total credit in account should not exceed Rs.1 lac in one financial year.

- The Account is valid only for 12 months, before which customer has to submit a valid OVD to the bank. This period can be extended by bank for another 12 months if customer produces the proof for applying for KYC documents.

- This account does not provide banking facilities like ATM, Cheque Book, Internet and Mobile Banking.

Conclusion

Thus with the various provisions government is trying hard to bring every citizen under digital India by providing options from every sector of the country.

Among the three Account Types banks always recommend a Normal Account, as it does provide easy way of identifying and managing the customers.

But for an individual also opening Normal account is better among the three as it provide all the facility, without any more visits to the branch. Thus it is better to open Normal Account unless you do have any issues.

Pingback: What is KYC (Know Your Customer) Policy in Banks? - Fil Zill